Thomas Barwick/DigitalVision by way of Getty Pictures

Journey + Leisure Co. (NYSE:TNL) has been working with complications above the previous few of years, thanks to COVID-19 pandemic and unstable demand dynamics in the hospitality sector. As the overall economy reopened so also did Travel + Leisure’s organization but things search set to stall all over again. Investing in timeshare firms at the commencing of a new business enterprise cycle can frequently deliver prospects for significant returns. Timeshares are a remarkably cyclical marketplace so it operates the two methods. In downturns, luxurious significant-ticket products like timeshares get hit the toughest but the rebrand to Travel + Leisure gave Wyndham Locations a several new equipment to help the company cope all through difficult times like these. Now we’re likely to choose a seem at some of the most up-to-date resources and see how they could be benefiting investors in the in the vicinity of future.

The Merchandise

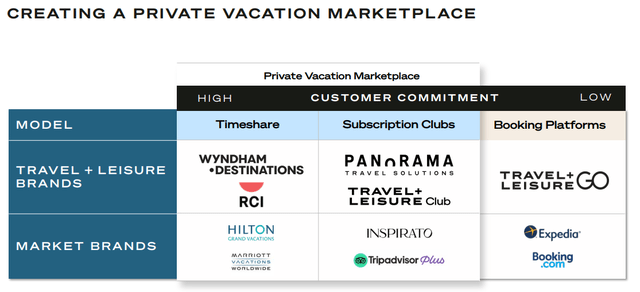

Travel + Leisure is nevertheless a timeshare organization, but their special get on the item differentiates them. In its place of a traditional timeshare, Vacation + Leisure sells family vacation golf equipment. Customers can design their very own vacations and they can use their ownership in a selection of approaches. It was the Apple iphone minute for Travel + Leisure. They also nevertheless get routine maintenance fees for their timeshare choices which is a handy kind of passive income. This permitted the enterprise to concentrate on creating a solid portfolio as a substitute of acquiring and advertising one pick place at a time.

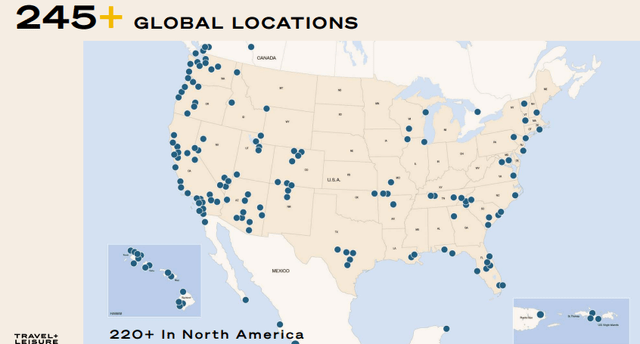

Acquiring a strong lodge portfolio is expensive and generates a big barrier to entry for competitors as they have to go up in opposition to an overall fleet of resorts versus just a person attractive location and the TNL portfolio offers some 245 destinations in some of the most beautiful spots.

Journey + Leisure

As a result, the price of timeshare shares is dependent mostly on the variety of merchandise and locations they give. Having a deep location catalog makes it harder for competition to poach prospects and is a significant offering stage for new buyers. It also provides shareholders confidence in the firm’s means to retain existing customers. Travel + Leisure has performed properly making up its catalog.

Travel + Leisure also has the RCI Trade that facilitates the buying and selling of timeshare- and it is really 1 of the world’s major by quantity. They’re effectively a 1-cease shop for all points timeshare and it usually appears to be associated in any revolutionary answers in the space.

Some thoughts have been raised about the timeshare industry’s capability to appeal to millennial revenue, but there are some initiatives underway that need to aid it strengthen. Vacation + Leisure commenced featuring membership providers to millennials who are not as probably to commit to a long-expression investment decision. The introduction of Panorama’s membership products and services could be pivotal for Travel + Leisure, specially in gentle of recent competitiveness from Airbnb and other shorter-time period lodging products. Subscription companies could quite very well conclude up becoming the future frontier in the timeshare marketplace.

Journey + Leisure

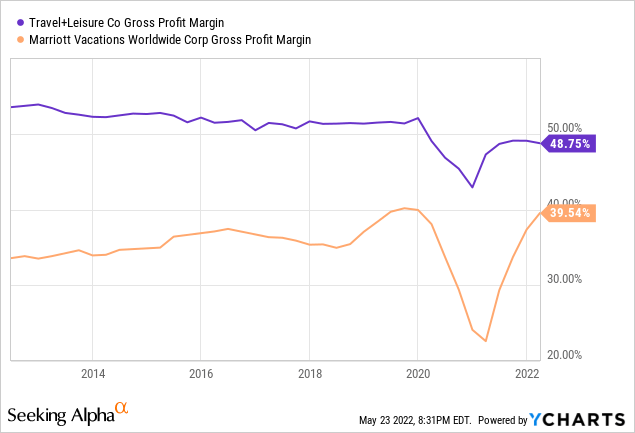

Strong Gross Margins Write-up Restoration

Thanks to an improved value proposition relative to larger hotel prices and solid employment figures, TNL’s foreseeable future outlook is hunting promising.

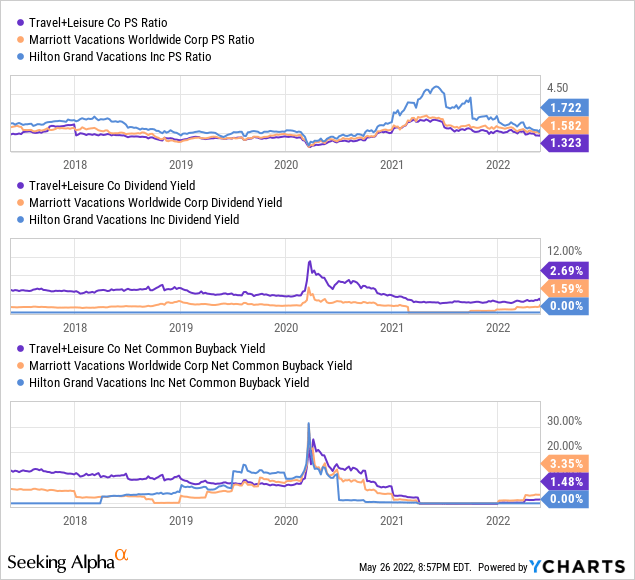

The corporation enjoys sturdy gross margins thanks to pricing ability but they have been declining. The Wyndham Destinations offerings exist at the medium degree of the pricing spectrum. As opposed to far more lavish offerings like the Marriott Vacations golf equipment, you’d assume Journey + Leisure’s offerings to have significantly less favorable margins but they actually outperform.

This is truly a testomony to the organizational performance of the leadership staff. Costs have been in a position to harmony out the expenses, leading to larger revenues. Regulate around upkeep agreements and a good commission-dependent design enable the business to proficiently go on expenditures to prospects.

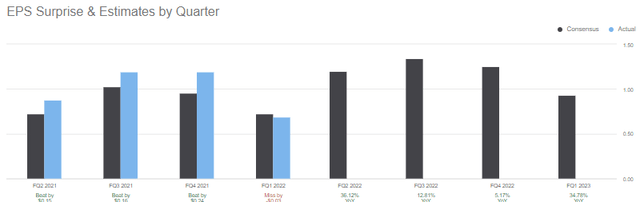

The recovery has truly taken root for the enterprise. EPS tendencies have been favorable until eventually just lately. The company has a cyclical element to revenue and has just lately been beating estimates for the most part.

Trying to find Alpha

Most notably in their family vacation ownership enterprise, the enterprise had an ordinary VPG (quantity per guest) of $3,377 in Q1 is increased than ever ahead of for the business and 40% previously mentioned previous year’s numbers. It is also critical to recall that inflation is great for their business. Premiums for inns and family vacation residences are increasing. This helps insert benefit to the timeshare thought for individuals as it will become extra charge-efficient relative to remaining in other sorts of accommodations. Curiosity prices rising on the other hand are more concerning.

Poor Conditions for Cyclical Performs

Stories from the Federal Reserve recommend that we are heading toward fee hikes between 3-5 times this calendar year. This will be the very first time costs have greater considering that the commence of the pandemic-induced lockdowns and it could have an affect on financial growth and fairness rates. What is more, there is a inclination in the timeshare business to finance purchases so a extended interval of better rates will enhance the general price tag of VO items to the consumer.

Lengthy-phrase investors who continue to keep their eyes open up really should have a lot of opportunities if they stay diversified. The marketplace has been obtaining much more unstable as charges rise and points get tenser abroad.

They affect the volatility of shares and their multiples. When curiosity charges are substantial, stocks are a lot less appealing due to the fact they offer you reduce returns.

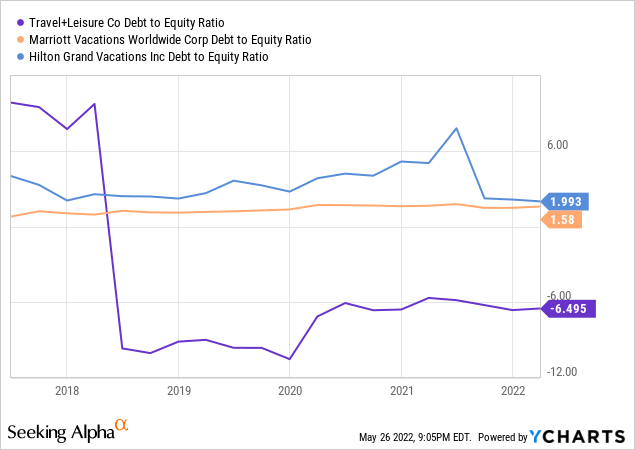

The hospitality field is one of the most affected by interest costs because corporations have a tendency to have a superior debt-to-equity ratio.

This signifies that when curiosity costs go up, so does the cost of borrowing income for these businesses. This puts timeshare businesses in a tricky location. They have to fork out a lot more to borrow cash for the reason that of the desire premiums. They tend to avoid this by creating somewhat stable agreements with set premiums for revolving strains of credit score. This is the place Vacation + Leisure stands out against its peers. They have nearly no financial debt and no urgent require for liquidity injections. It is probably that they might secure credit score to beef up the stability sheet if the overall economy was to go south in a big way but the organization has finished this sort of a good work handling its liquidity and total cost of capital that such a shift must be swiftly forgiven if it were being to transpire.

There is also the simple fact that a economic downturn is not all doom and gloom for larger sized knowledge gamers like Vacation + Leisure. There is generally area for vital acquisitions at useful rates and Wyndham has done some incredible promotions in the previous. Journey + Leisure is an outgrowth of the Wyndham manufacturer but it will be attention-grabbing to see if they can have equivalent accomplishment in the event of a downturn.

Summary

Journey + Leisure is fairly valued proper now. We could be likely into a major slowdown and they simply call hospitality a cyclical enjoy for a reason. I am in no way going to propose getting a timeshare inventory on the cusp of a recession but there is a good deal to love about Journey + Leisure in this article. The inventory has marketed off a whole lot but it could nevertheless go decreased. I would not be in a rush to purchase just yet but I see no explanation why investors ought to hurry to portion with their shares at this degree. I amount the inventory as a Hold.

More Stories

How Travel Directories Are Helpful for Common Travllers

Ten Little Known Facts About the Vacation Hot Spot of Wildwood, New Jersey

Discover Serenity at Svaha Spa Bisma