amriphoto/E+ through Getty Illustrations or photos

Thesis

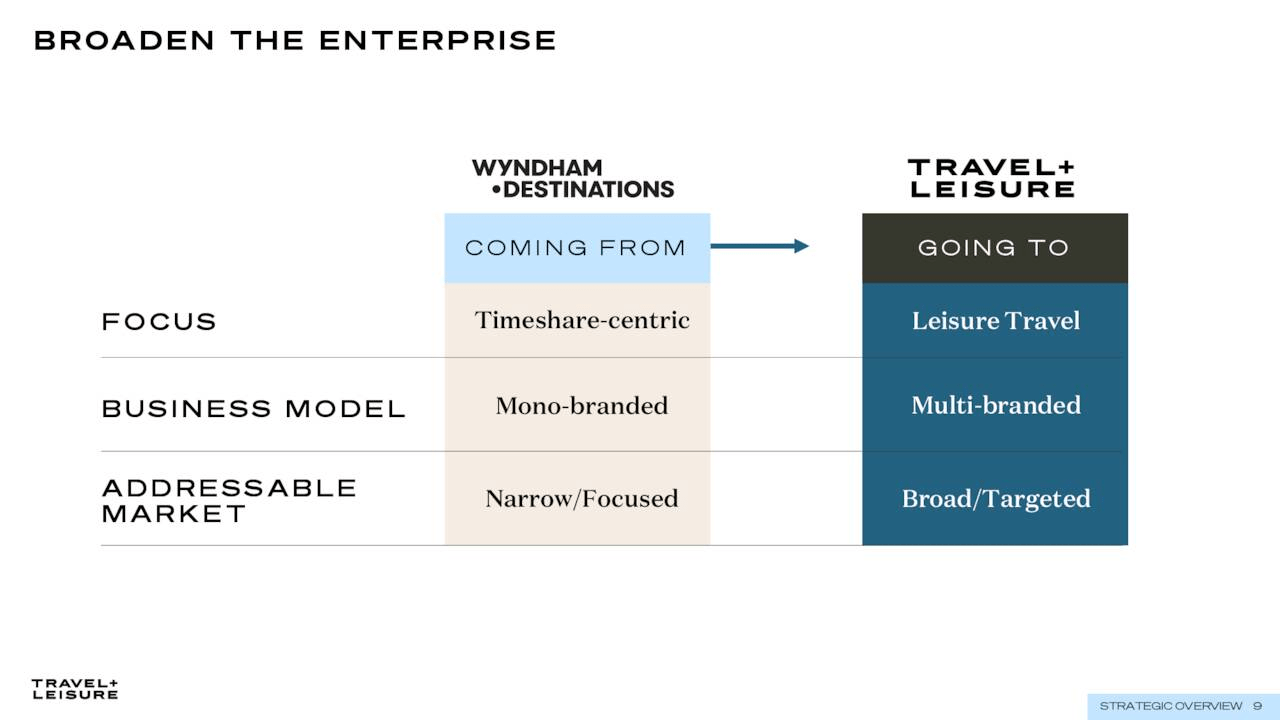

Travel + Leisure (NYSE:TNL) is rather an attention-grabbing new conglomerate in the vacation market. Formerly component of Time Magazine owner Meredith Co (GTN)(IAC), T+L the journal was acquired by Wyndham Lodges (WH) spin-off Wyndham Locations, which are principally timeshare resort operations, but Wyndham took the famed magazine’s name. The objective of the acquisition and rebranding below the T+L banner was for several reasons. To start with, move absent from adverse timeshare stigma due to legal rights and price. Second, maximize visibility of the platform under just one banner. Third, improve operational efficiency by means of integration, all even though expanding purchaser foundation. The corporations are now capable to operate alongside one another, somewhat than alongside every single other, and administration expects these synergies to travel progress and gains.

I assume the final results to be favorable, but there is a good deal of competition in the “way of life vacation” section, these kinds of as Airbnb (ABNB). As traders, it will be significant to pick sections of the business that are presently weak, but supply upside prospective as effectiveness returns to form. The uncertainty around TNL delivers a steep undervaluation all although synergies concerning working units will allow for the organization to outperform. While fiscally the jury is nonetheless out, the expense is absolutely really worth consideration more than the upcoming few quarters thanks to the favorable valuation.

TNL

The New Journey + Leisure

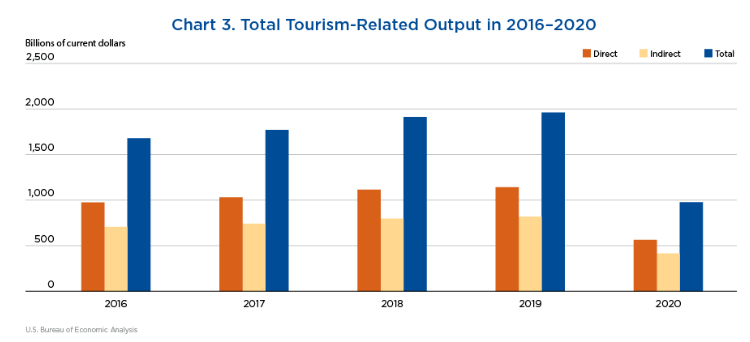

Prior to merging, the two independent entities have been extremely specialized, a person a timeshare service provider and the other a vacation journal. With print media using a hit more than the previous couple of many years, most likely as a consequence of declines in political fascination, Travel + Leisure invested closely into their on the internet platform. Also, the brand name proceeds to offer annually award rankings of the top rated hotels, locations, and regions of the environment. The publication is normally rated as the leading good quality title in the sector and has gained plenty of fans the planet about. Completely, if journey popularity improves to levels found prior to the pandemic, T+L is established to improve with the marketplace. On the other hand, timeshares are a different tale as their financial viability and popularity wanes more than time, primarily with steep competition from holiday rentals and standard lodge/motel.

USBEA

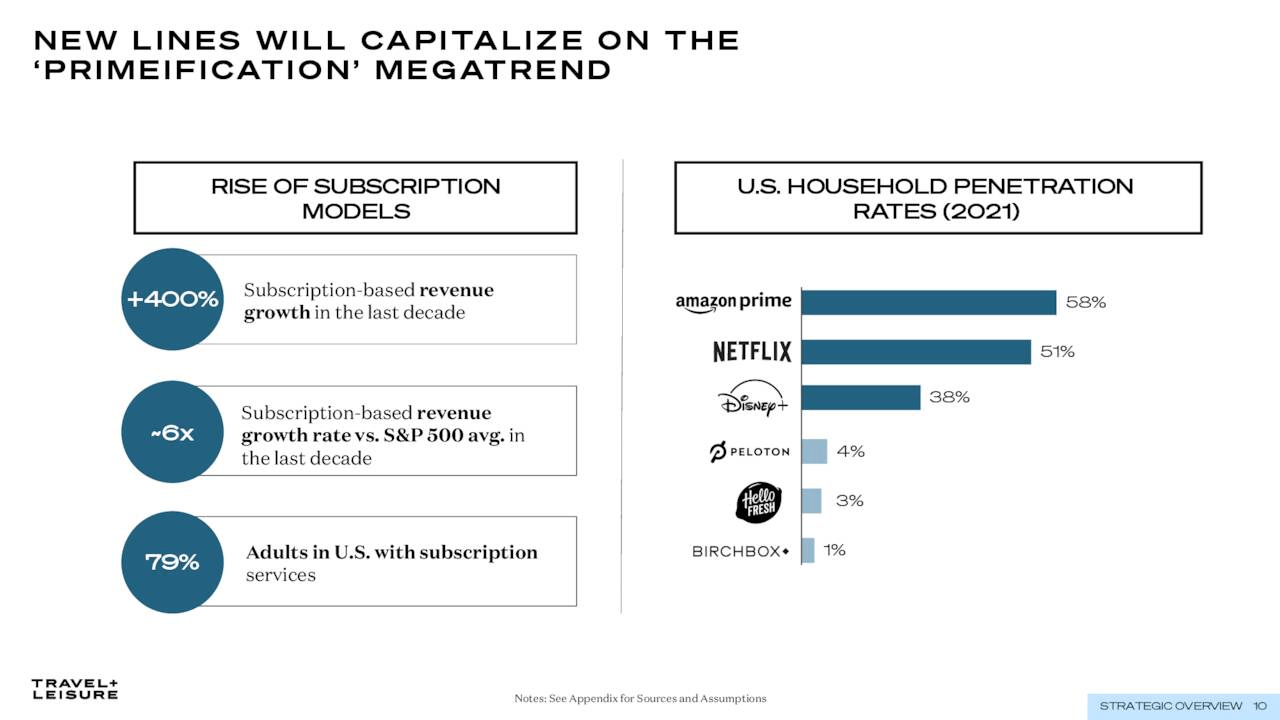

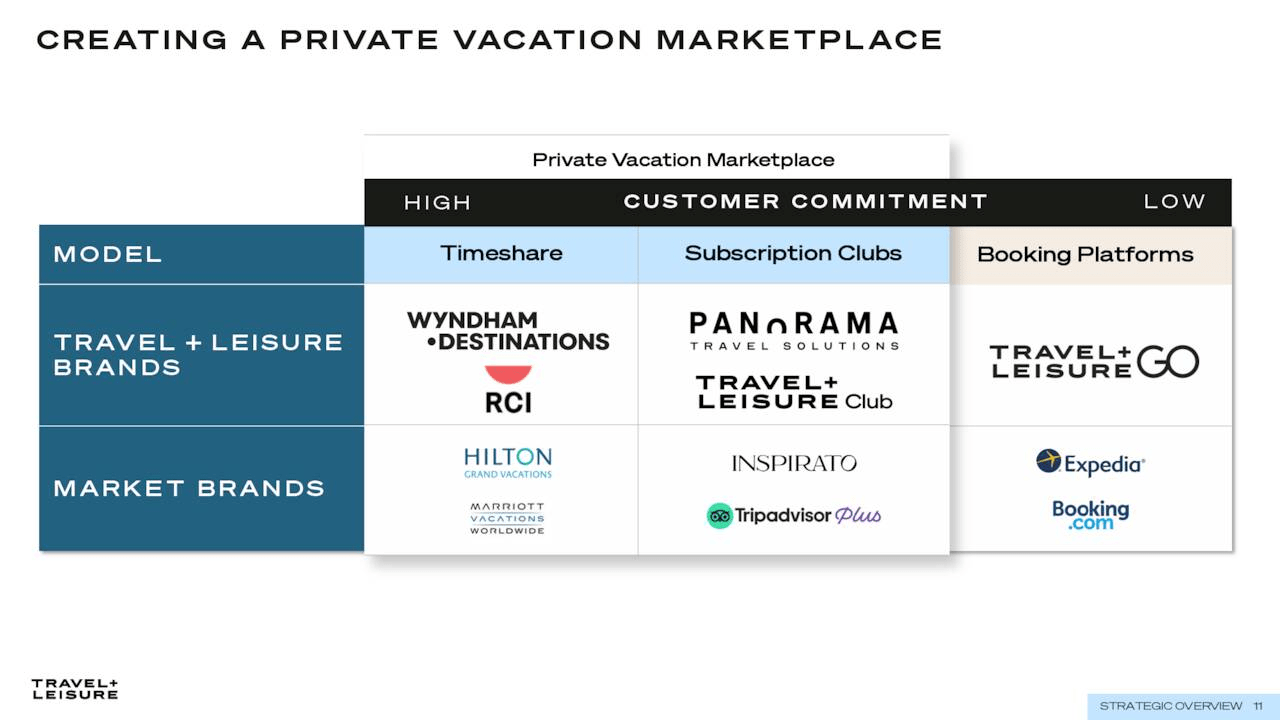

To deal with some difficulties, the company is shifting business enterprise procedures, opting to go with the well-liked subscription product. This consists of the many Wyndham Locations Clubs, Journey + Leisure Club, and Journey + Leisure Go. Wyndham Club and other folks, backed by the extensive catalog of timeshares inside of the RCI system, now allow members to opt for numerous resorts, alternatively than remaining stuck at a solitary a person. Applying a factors model, a variety of tiers of memberships have different awards, but members get locked into extended-phrase contracts.

To have additional lenient and significantly less confusing choices, TNL now features Travel + Leisure club, a at the moment $15 ($19.99 when not on sale) every month subscription that offers access to excursion savings, private concierge, and curated itineraries. This membership is not contracted and can be canceled at any time. Nevertheless, this platform however favors far more affluent buyers who are equipped to travel extra frequently, a lot like timeshares or travel credit score card rewards.

As these types of, a third company system was extra, TNL Go. The web-site delivers considerable and several itineraries for travelers and usually delivers hyperlinks to sign up for TNL Club. Though a lot more of an intermediary in between the magazine web-site and club, potentially the company will glimpse to build on-line scheduling characteristics related to Scheduling.com (BKNG) or Expedia (EXPE). The company also delivers the Panorama application system that allows condominiums, flats, and/or resorts and other holiday vacation rentals to have their own web site system for bookings.

There are other elements I could discuss, but the gist is that the magazine web-site drives targeted traffic and the desire to vacation, then initial vacationers will appear at itineraries on the T+L Go site. Right after taking pleasure in a trip, those who want to keep on touring or vacationing all through the 12 months will join T+L Club. Then, the prime-tier of earners or retirees with excess income will be the most important purchasers of timeshare club memberships. This constructive comments loop will allow for the synergies concerning units that I talked about earlier. While, 1 must be considerate of excessive spending on the tech platforms, and a single consolidated website or membership may well be improved. I am absolutely sure the firm will evaluate this contingency as properly.

TNL

TNL

Financials

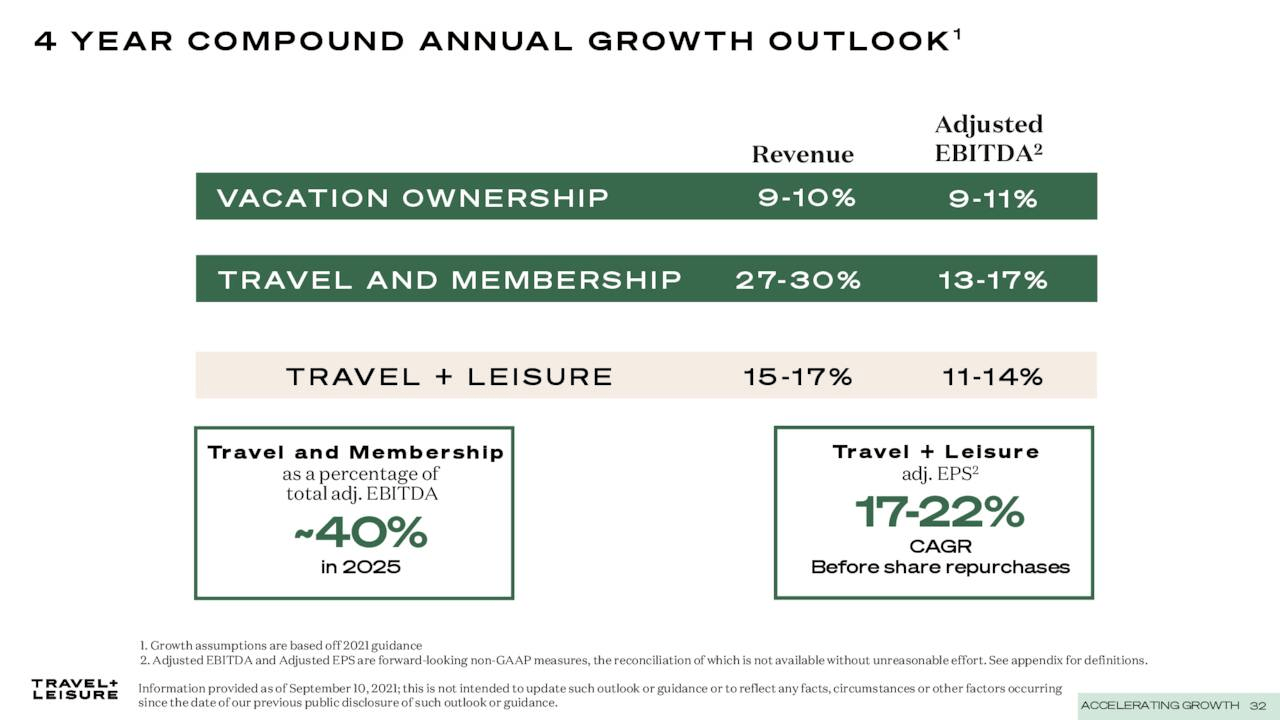

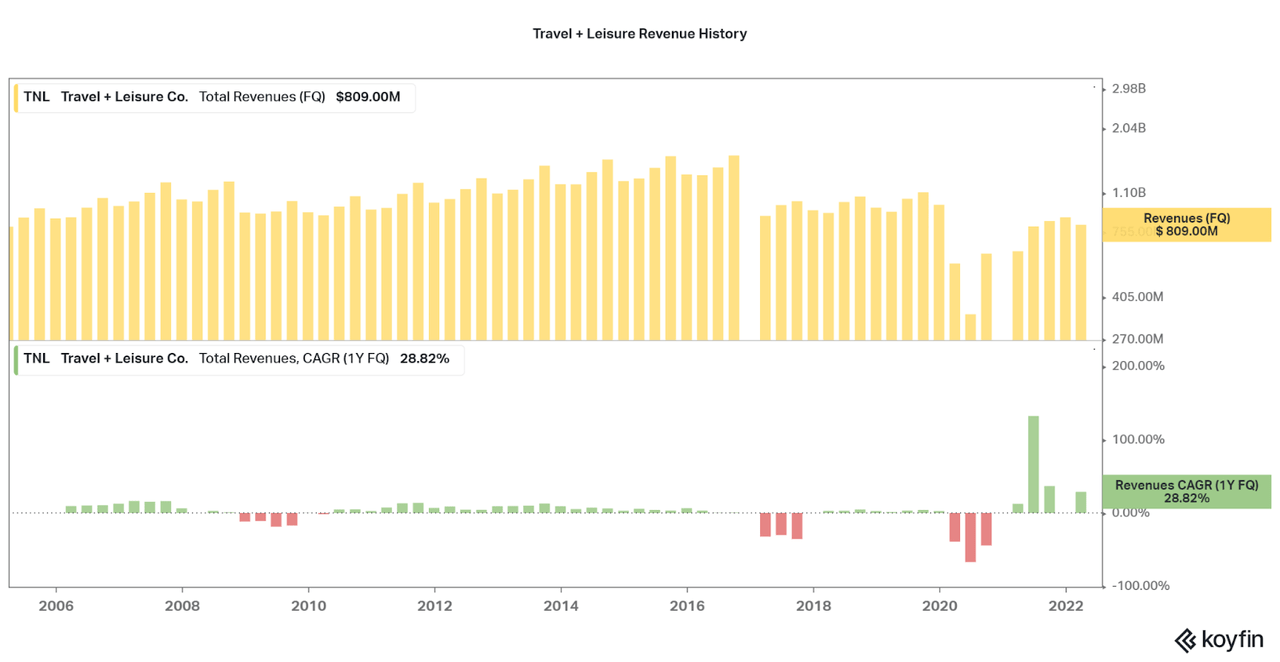

So, how do these adjustments have an affect on the financials? When the organization expects substantial advancement more than the following four many years, we can make little insights into whether or not this is over and above prior general performance. So much, revenues have rebounded to a bit significantly less than 2019 revenues, and are fewer than what the Wyndham business enterprise observed on its very own prior to merger. Having said that, most travel business names are continue to receiving much less revenues than prior to the pandemic. As this kind of, I imagine it will get some time to be equipped to crack down the revenues and progress potential of the business.

For the minute, the driving catalyst will only be a return to pre–pandemic travel ranges. Issues with inflation and recessions will also hinder the stock, so the return will very likely be slower than anticipated. Nevertheless, in the lengthy operate, I do not believe the company will return to the earnings advancement witnessed in the 2010-18 time period, and will in reality expand quicker.

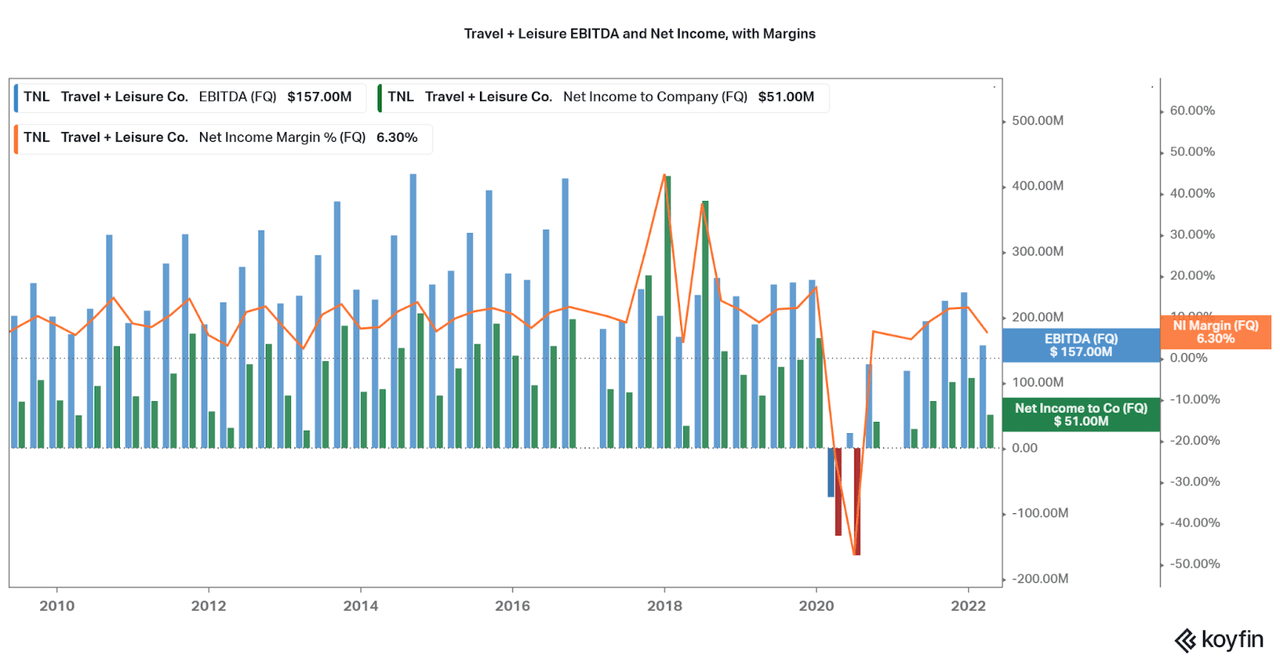

TNL Koyfin

Though 2020 was met with steep losses originally, I uncover that T+L was in a position to maintain potent profitability during the later levels of the pandemic. In truth, two quarters had been damaging, but then by 2021, the web cash flow margin returned above 5%, with some quarters hitting 10%. The timeshare industry has a heritage of sluggish, but profitable growth, and it appears this pattern permitted for security into 2021. I also feel the journal section remained powerful as properly, as the drive for journey material did not subside, just the functionality to travel I know I prepared out several excursions for the moment I could journey once more above the past two yrs.

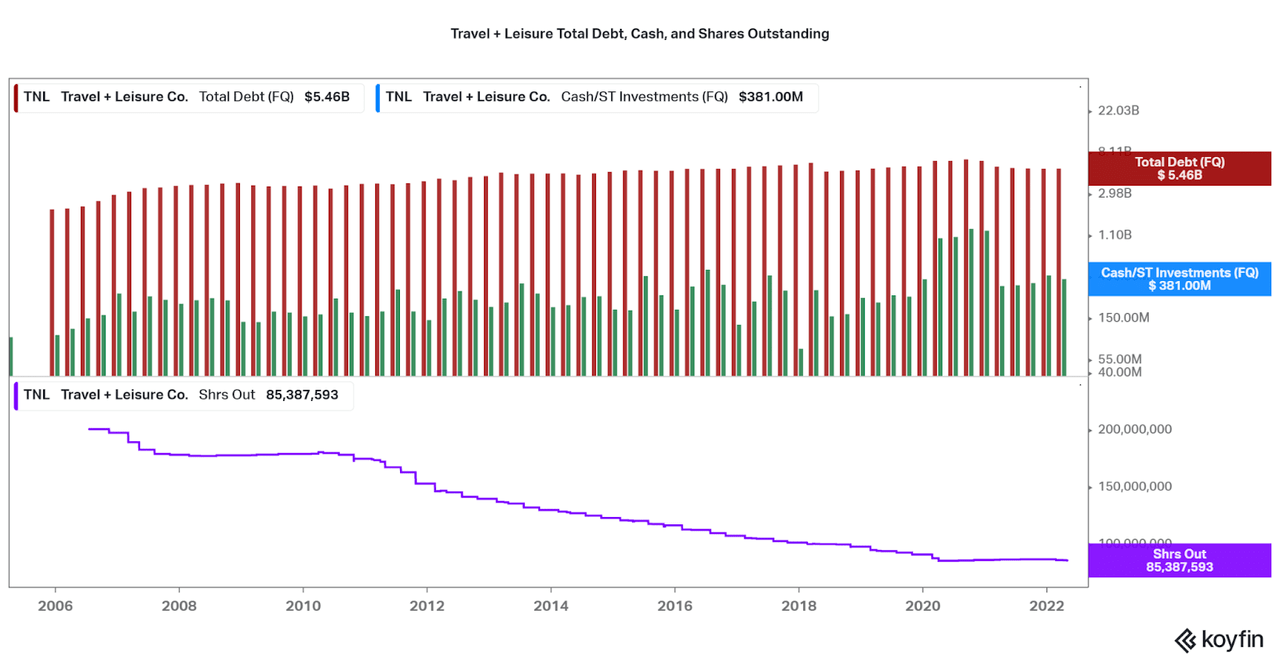

Koyfin

Taking a seem at the balance sheet also paints a contrasting photograph. Even though there is substantial debt on the equilibrium sheet, money levels in fact enhanced in 2020/21. I like to see that personal debt is not expanding as a end result of the pandemic, and this may well be a constructive advantage to the freshly merged corporations. Further more, the business had a history of steadily reducing the over-all share depend, and dilution did not occur during the pandemic. Even though I feel TNL features a safe harmony sheet, I would proceed to continue to keep check out alongside with the relaxation of the financials as vacation returns to regular. There is a great deal uncertainty in the market and financial system, and no need to rush into an expenditure.

Koyfin

Value and Valuation

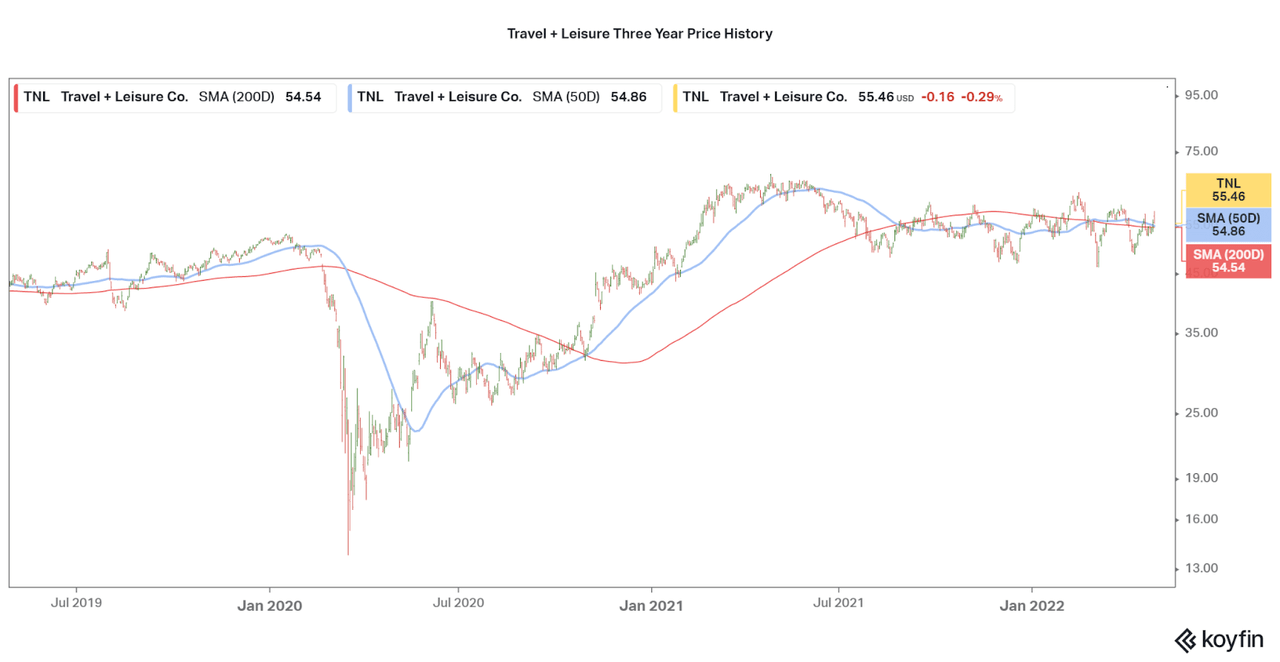

As the company has experienced a significant alter with their internal framework, and the pandemic hit at the worst time, TNL‘s share rate has failed to achieve highs observed prior to the pandemic. There was an preliminary surge alongside with valuations final summer months, but this immediately fell afterwards, despite the fact that a holding sample has emerged between $40 and $60 for every share. When it is very apparent to investors that they ought to have purchased through pandemic lows, we can also glance at the valuation of the corporation as possible assistance for the expense.

Koyfin

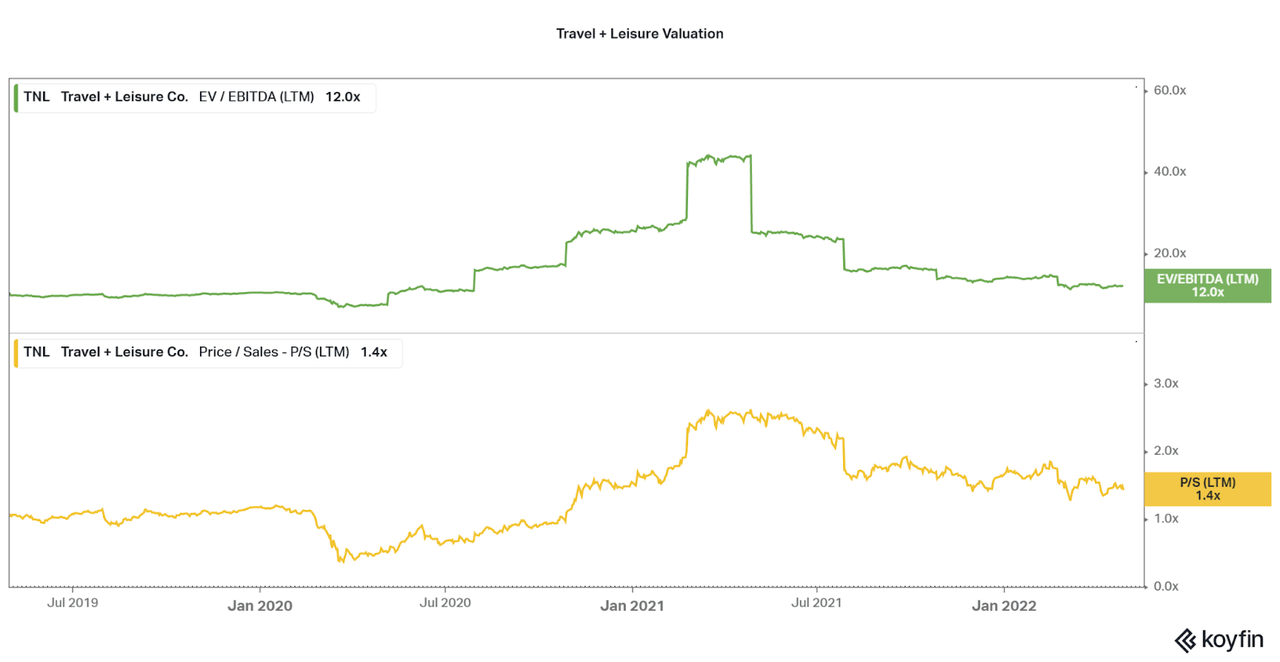

When the cost to earnings chart features very little insight and is excluded, the recent P/E of TNL is a meager 14.5 (TTM, GAAP). This indicates the market place is pricing in very little growth for the business, even as performance returns. This is highlighted by the EV/EBITDA benefit of 12.0x, slipping steadily considering that previous summertime. Further signs of weak spot are in the P/S, but because of to the lowered revenues, continues to be previously mentioned lows of 2019 and 2020. Any favorable earnings growth and maintained profitability will rapidly travel the valuation reduced. As an investor, it will be critical to evaluate irrespective of whether values will continue on falling, keep the exact, or expand. Even so, I desire not to gamble, and I would think about the business moving into into fair or reduced valuation territory from in this article.

Koyfin

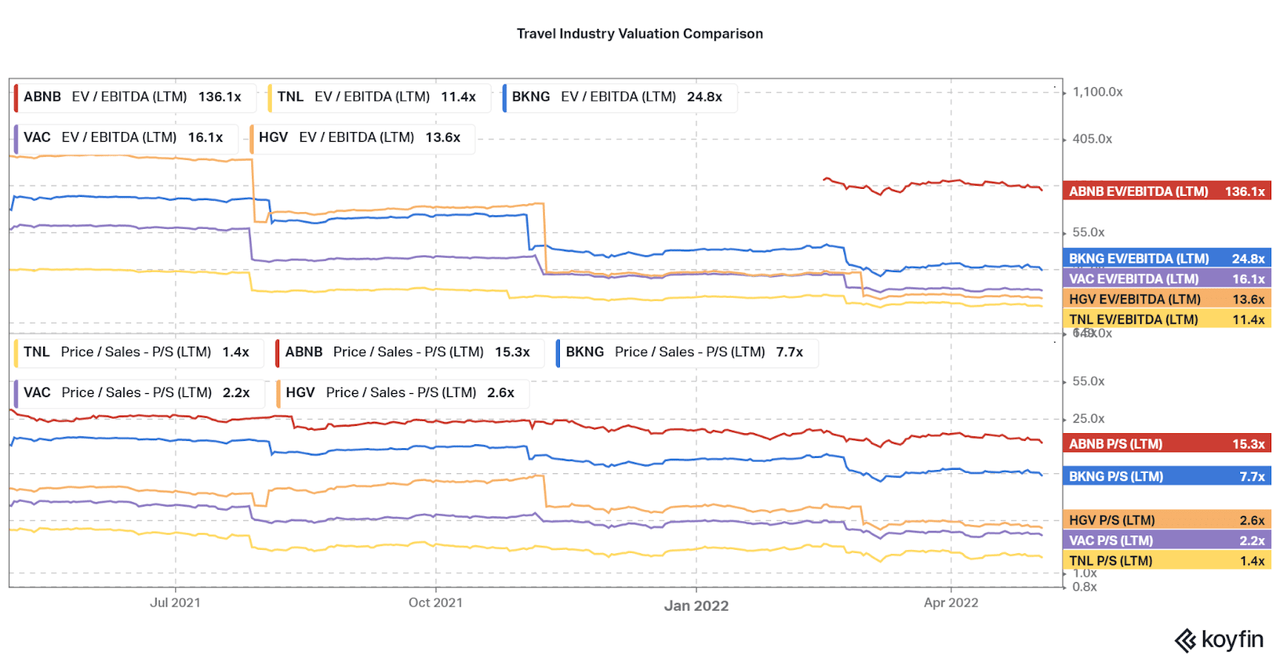

One more way to evaluate Travel + Leisure is by comparing the valuation to peers. When functionality is difficult to assess due to TNL‘s new standing, it is simple to see that the organization retains a considerably reduce valuation than any peer inside of the vacation marketplace, even other timeshare or itinerary vendors this sort of as Hilton Grand Vacations (HGV) and Marriott Vacations (VAC). Meanwhile, scheduling platforms these as Scheduling.com and Airbnb hold far higher valuations, even as their have expansion costs falter. In this latest current market era, worthwhile, secure development will keep a larger valuation, and this favors T+L as tourism returns in time. Of course, all of these names supply a little bit various exposure to the market, and ought to also be assessed for their own deserves.

Koyfin

Summary

I believe that Vacation + Leisure is 1 of the additional distinctive shares in the travel sector, and undoubtedly worth thought at latest valuations and upside likely. Though anxieties about further COVID variants, intercontinental travel, and even a economic downturn weigh large on the outlook, T+L appears to be doing very well now that they are blended with Wyndham Destinations. Also, a rebranding of timeshares, and a reduction in their unfavorable attributes (this sort of as non-cancelable contracts), will enable for a resurgence of the marketplace superior than with peers. The recently recognized opinions loop of generating want to vacation (magazine/website), furnishing travel setting up and concierge provider (T+L Club), and then lastly the larger worth timeshare ecosystem for these who want the total working experience, is a constructive catalyst for the business‘s prospective. Although I will be sitting down on the sidelines for the instant, I may perhaps see an possibility to invest in if the share rate goes down much even further.

Thanks for reading, enable me know what you consider in the comments.

More Stories

How Travel Directories Are Helpful for Common Travllers

Ten Little Known Facts About the Vacation Hot Spot of Wildwood, New Jersey

Discover Serenity at Svaha Spa Bisma